Clinton Capital Partners is a VC advisory business that specialises in raising capital and growing shareholder returns, for early stage companies and their investors

In addition, we invest our own funds to align company, investor & advisor

Clinton Capital Partners has a long and established track record of raising capital, growing companies, conducting mergers, creating liquidity events, and ultimately delivering shareholder returns for early stage companies and their investors.

Our company motto "Yesterday's Principles for Tomorrow's Companies" has formed our investment thesis - honour, integrity, humility. We pride ourselves on the quality of companies we partner with, the quality of our investor community, and ultimately, our investment performance.

What we do?

- Capital Raising - Equity & Debt

- Advisory Services

- Investor Readiness - Structuring & Due Diligence

- Build, Grow & Scale Businesses

- M&A, Exits

- Shareholder Returns - ultimately deliver for both Company & Investor

Why an Advisor?

- When raising capital, we feel early-stage companies underestimate the time involved, the distraction to the underlying business, and the importance of identifying the “right culturally aligned” investors for their journey.

- Understanding the investor landscape and unknown pools of capital is key, as non-traditional VC investors now make up >70% of all venture funding

- The cost and implications to a founder and business of not reviewing all options, partnering with the wrong investor and on the wrong terms, are enormous – 2022 has been a great example of this.

Why Clinton Capital Partners?

- Track Record - >90 transactions across 9 years

- Experience - advised & invested in Australian VC >20 years

- Investors - relationships with >5000 global & culturally aligned family offices, boutique funds, VC funds, institutional funds, PE, corporates

- Success Based - no result no fee

- Skin in the game - we invest our own $ for the journey

- Trust & Reputation - we believe one’s behavioural patterns are different when one’s name is exposed

To find out more contact us

What we do

Clinton Capital Partners provide "Venture Capital" equity & debt advisory, capital raising & investment - seed, angel, series through to IPO.

We understand the challenges that come with a fast growing business. We simplify these complex business problems and provide the opportunity for partnership-style investments that benefit both investor and company. We facilitate the success of all parties involved, creating a win-win situation.

Clinton Capital Partners understands that the Investor and Issuing client universes are interlinked.

It's in understanding, simplifying and connecting the two that investment "returns" can be achieved.

With over 70 years of combined experience advising Investors, CCP offers "Wholesale Investors";

- Experience & Understanding When Investing In VC Companies

- Access to "Venture Capital" Opportunities Many Wouldn't See

- Rigorous Due Diligence Process

- Trust, Reputation, Credibility

- Track Record Of Investment Returns; and

- We Have Skin In The game

Clinton Capital Partners works with a range of companies from the Aspirational Entrepreneur, through to Government agencies.

Clinton Capital Partners prides itself on delivering the complex made simple and, can offer both small and large companies;

- Over 70 Years Experience Advising, Analysing & Investing In Companies

- A Trusted Partnership For The Duration Of The Journey

- Strategic Advice

- Access to "Strategic" Capital

- Direct Investment; and

- Proven Track Record Delivering Results

WHO WE ARE

Randolf Clinton

Clinton Capital Partners was founded by Randolf Clinton in 2015. Randolf has over 35 years of leadership experience in global investment banking and financial markets, having worked in London, Singapore, Hong Kong & Australia for companies such as JPMorgan, Credit Suisse, ABN Amro and RBS.

Starting out as a trader on the Australian Stock Exchange, Randolf has held various leadership positions and directorships across the globe, including Managing Director, Head of Cash Equities AsiaEx, Head of Equities Distribution AsiaPac at JPMorgan and Managing Director, Head of Equities at RBS. He has been responsible for businesses, products and teams across 15 countries managing upwards of 250 people generating in excess of $500-700m in revenues.

Randolf has a proven track record of building businesses and developing outcomes around complex situations. His passion for helping others achieve their business goals coupled with his extensive industry knowledge and experience is what makes Clinton Capital Partners a truly unique advisory business.

Brett Mikelsen

Brett has 25 years experience in finance and technology, with 10 years full-time in venture capital , leading or co-leading ~90 deals. He spent the decade prior in investment banking and wealth management at UBS, and as a former electronic engineer has worked with emerging companies as founder, advisor, and/or investor since 2000.

At UBS Brett was Director, National Sales Management for the wealth management business, which provides advice to family offices, entrepreneurs, and executives. Prior to banking he founded and grew a successful tech software business.

Brett holds a Bachelor of Finance, a Bachelor of Engineering (Electrical and Electronic), completed education in Venture Capital at Harvard Business School, and is a Graduate Member of the AICD.

Investor Network

We have circa 5000 active investors across the globe, from the following categories:

- Family Offices

- Boutique Funds

- Institutional Asset Managers

- VCs

- Private Equity

- Sovereign Wealth Funds

- Corporates

- HNW (Experienced & Connected)

What Our Clients Say

Completed Transactions

We have completed over 90 successful transactions - below are some examples

Liquidity Events

Clinton Capital Partners believe in creating liquidity points throughout the journey - not just at exit.

This gives early investors the choice to either take profits or hold, and companies the opportunity to continuously evolve the most optimal and relevant cap table

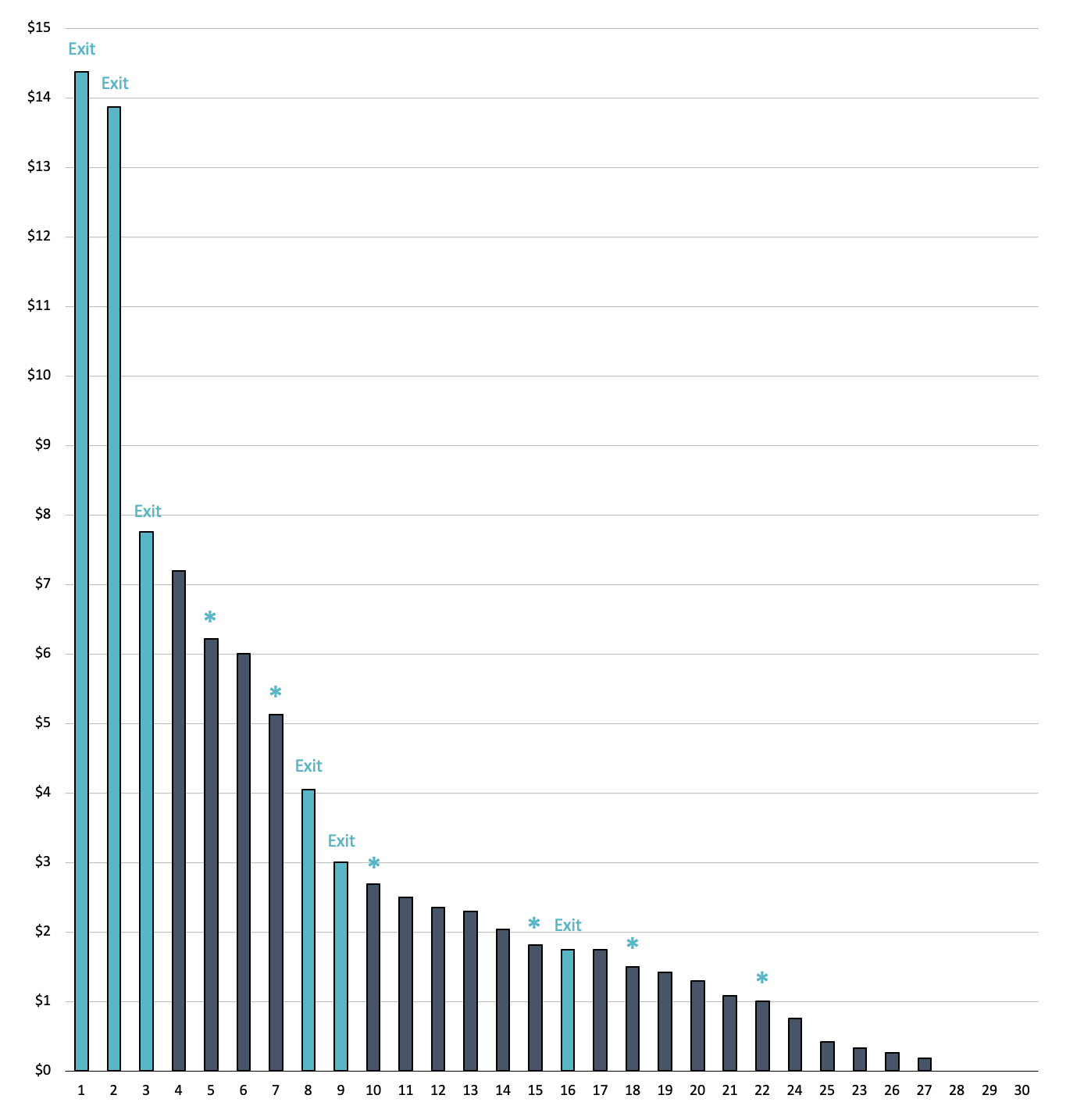

To date we have crystallised 18 liquidity events - we should note that while some investors may choose to crystallise a return along the journey, many companies have continued to increase their valuations posts these liquidity events.

Our Performance

Performance, marked return only (30 from 36 companies)

In the unlisted equity market, various methods are used to estimate current value of a portfolio. We will not attempt to accurately do this here, but instead give a partial insight into our returns, using instances where companies have had a follow-on round and has ‘marked’ a new valuation.

To date, our portfolio has delivered a 210% return had you invested $1 in each of our 30 companies that have marked or exited (total outlay $30).

We believe that our total performance when including the six companies that have not marked and including Sine, will result in a higher return.

In addition, as we don't charge investors establishment fees, management fees, nor performance fees, these returns are Nett.

Companies we have raised capital for

Contact

Ready for a successful partnership with your business?

Clinton Capital Partners

Sydney NSW 2000

Mobile +61 414 446 444

info@clintoncapitalpartners.com.au